Skandia

Insurance & Pensions

Digital Pension Planning Revolution

How Skandia transformed their pension advisory services with KidbrookeONE, launching a sophisticated digital planning solution in just 4 months.

Key Metrics

Implementation Time

~4 months

Go-Live Date

June 2020

Real-Time Scenarios

5,000 × 720

Engine Reuse

5 journeys

The Challenge

Complex Requirements

Legacy IT infrastructure with outdated systems that were hard to integrate. Skandia needed a sophisticated calculation engine capable of handling economic scenarios, complex tax rules, business logic for customer journeys, and compliance requirements. Rising customer demand for digital services required consistency across all channels while maintaining holistic advice covering the entire customer balance sheet.

The Solution

KidbrookeONE Implementation

Adopted KidbrookeONE API to provide a robust, flexible calculation engine. Leveraged Kidbrooke's deep vendor understanding and quantitative finance expertise to accelerate time-to-market while ensuring regulatory compliance and sophisticated scenario modeling.

Implementation Journey

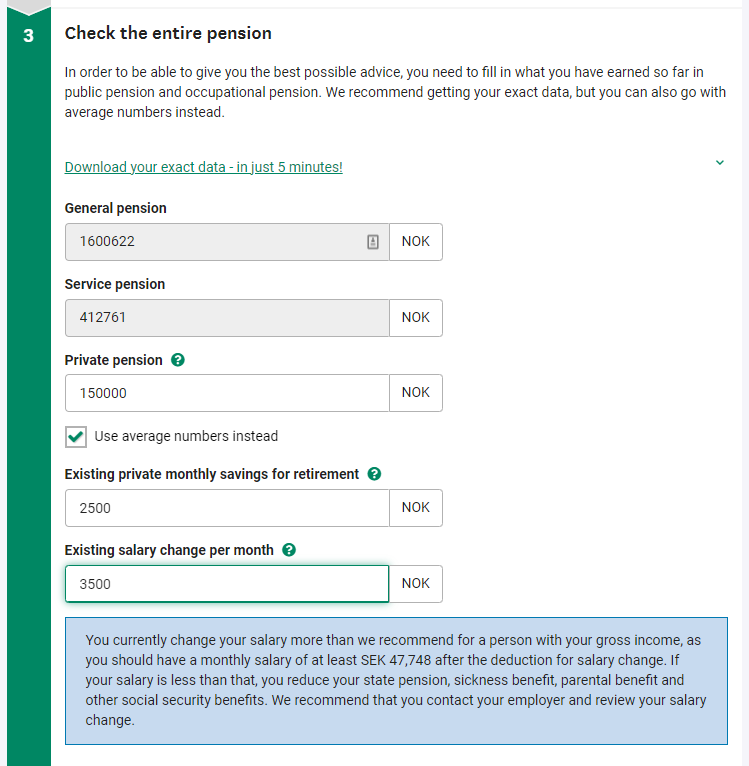

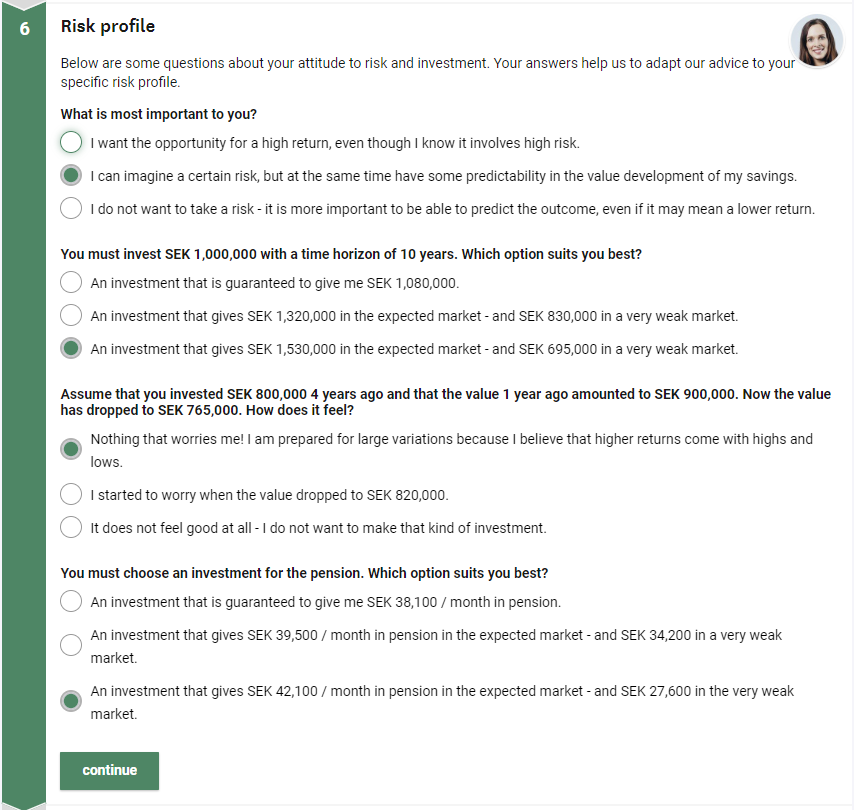

Step-by-Step Process

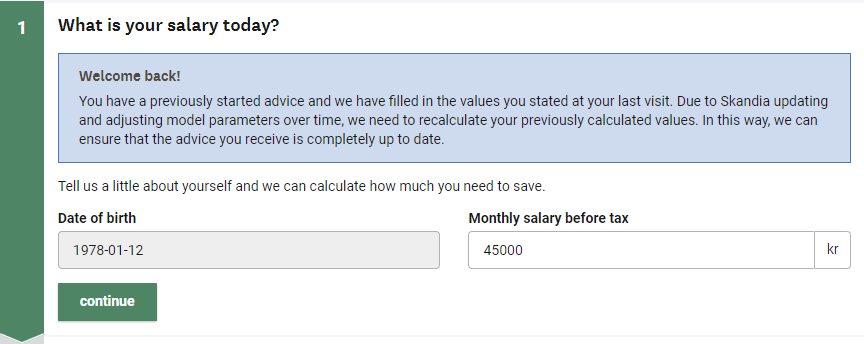

Step 1

1 of 11 steps

Pension Objective

User enters DOB and gross salary; minimal inputs to entice continuation.

The Results

Measurable Impact

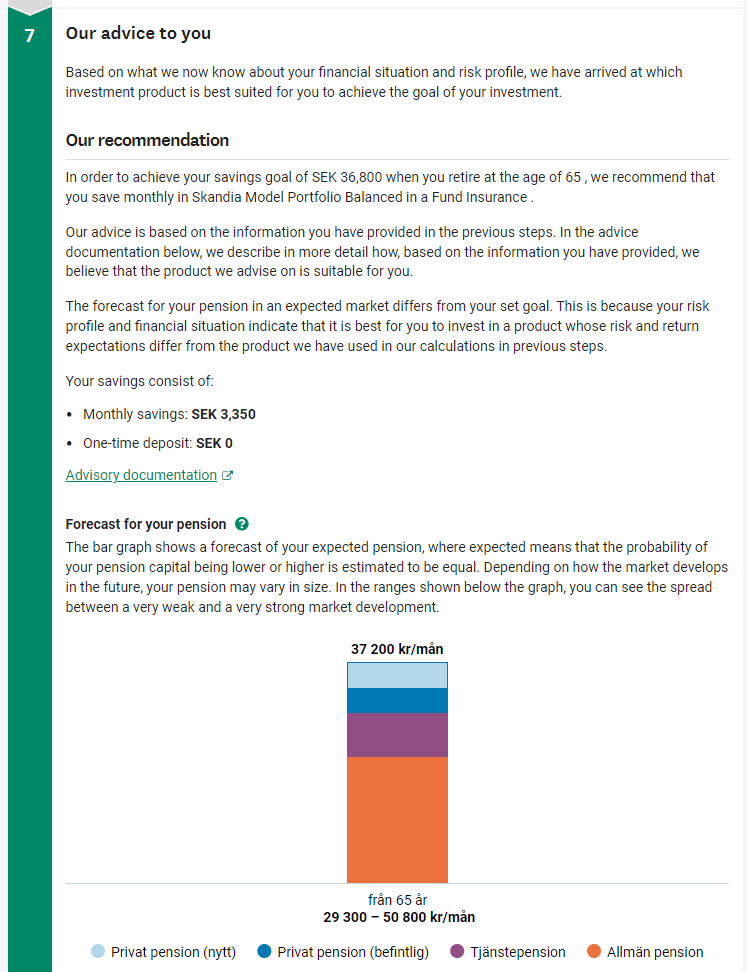

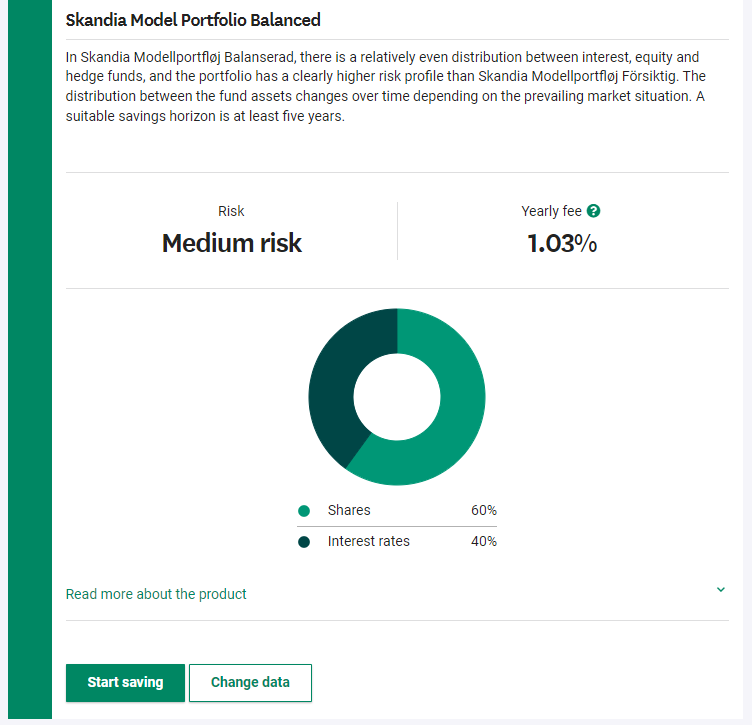

1

Regulated advice pack automation: PDF with full advice documentation generated and stored in "My Page" for each advice session

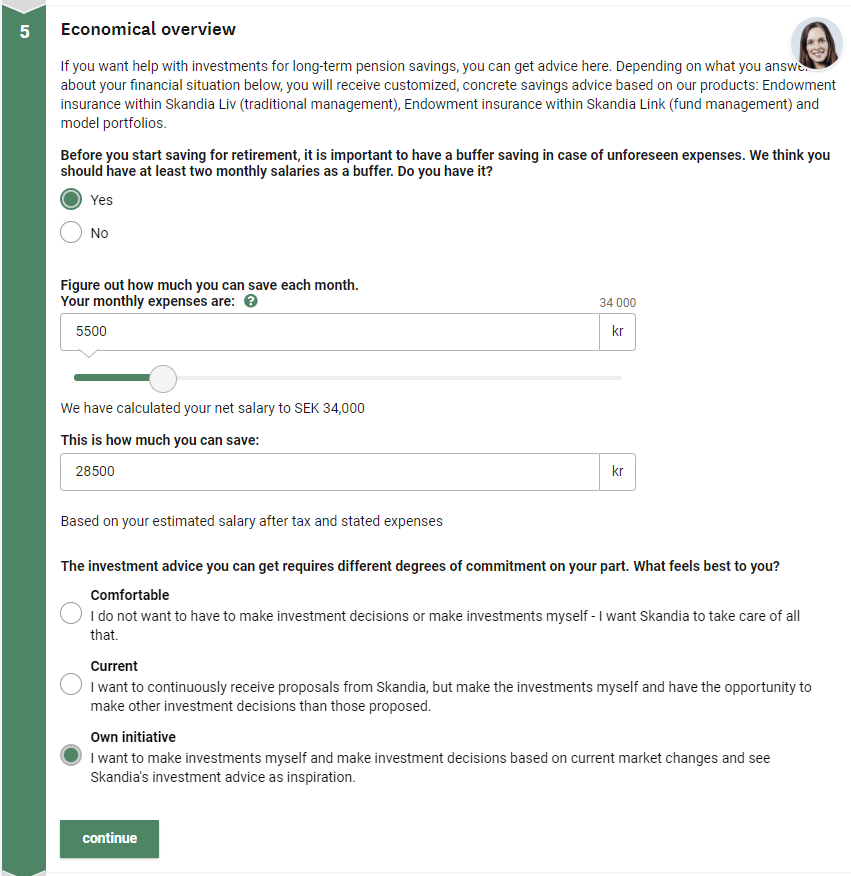

2

Affordability & suitability controls: Enforces buffer-savings/affordability checks before committing to monthly investments

3

Tax-aware guidance: Detects sub-optimal salary sacrifice via embedded tax logic

4

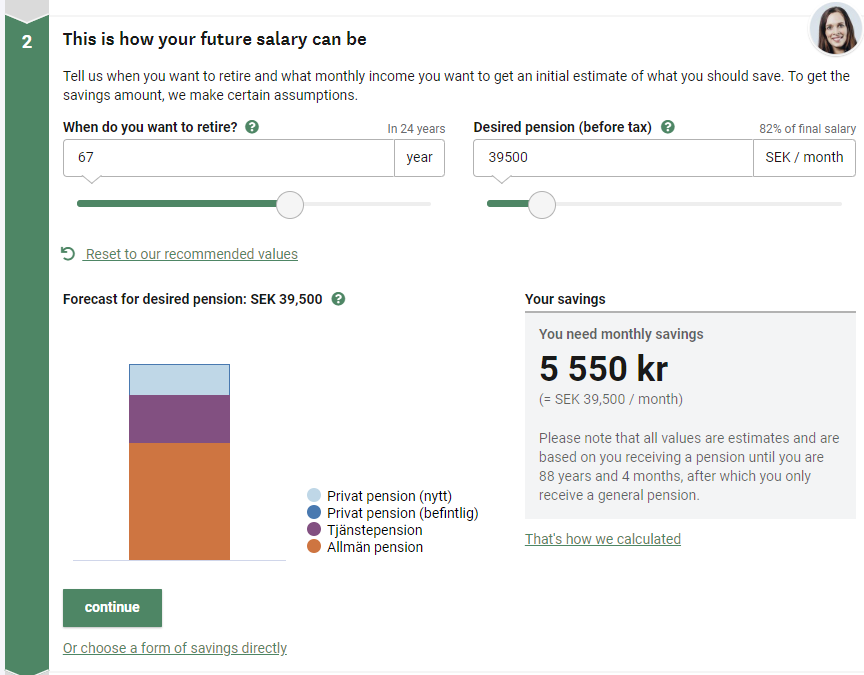

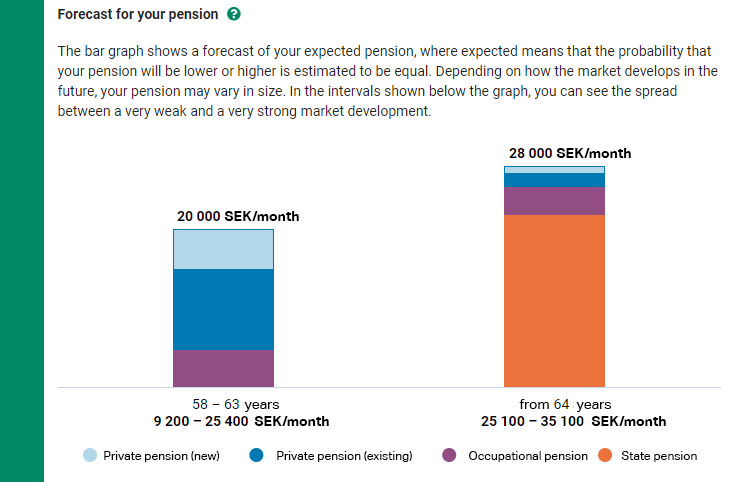

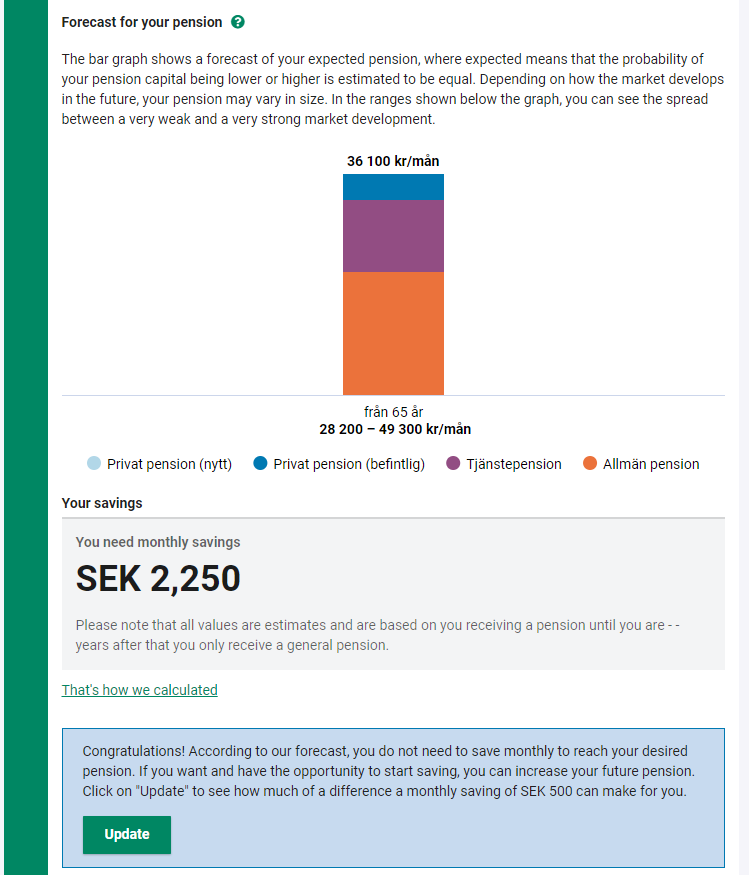

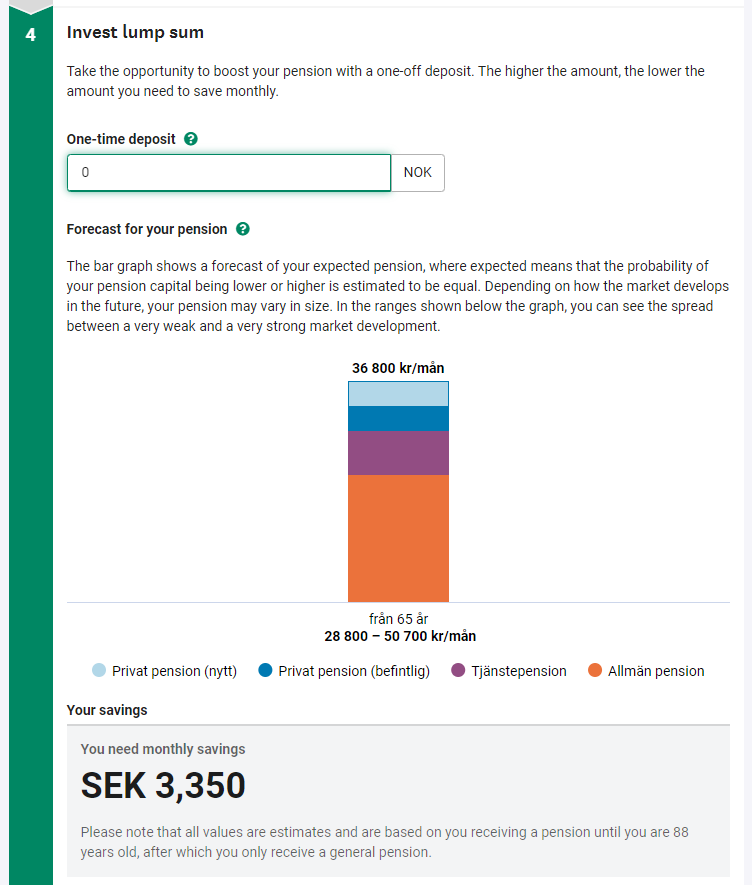

Multi-period goal handling: Supports split retirement incomes and allocates capital across periods automatically

5

Real-time simulation scale: 5,000 scenarios × 720 time steps per recalculation (≈3.6M time steps per change)

6

Reduced time-to-market for new products/services and engagement trending up post-launch

Client Testimonials

What They Say

"Digitalisation is the only way to scale financial advisory services."

Joakim Pettersson

Head of Digital Advisory, Skandia

"We use Kidbrooke's KidBrookeONE and are very pleased with the market-leading functionalities and flexibility."

Joakim Pettersson

Head of Digital Advisory, Skandia

Looking Forward

Skandia's Future Vision

"

Digital advice will democratize financial guidance, making it accessible beyond just wealthy clients. Advisors initially hesitant but quickly adopt tools once they see benefits. Future focus on empowering customers with intuitive, visual, pedagogical experiences covering mortgage, part-time work, saving, pensions, and buffers.

Skandia's Vision

The future of digital financial advice

Ready to transform your financial services?

Schedule a personalized demo to see how KidbrookeONE can accelerate your digital transformation