Powering Next-Generation Wealth Experiences

One unified platform. Limitless financial use cases. Zero implementation headaches.

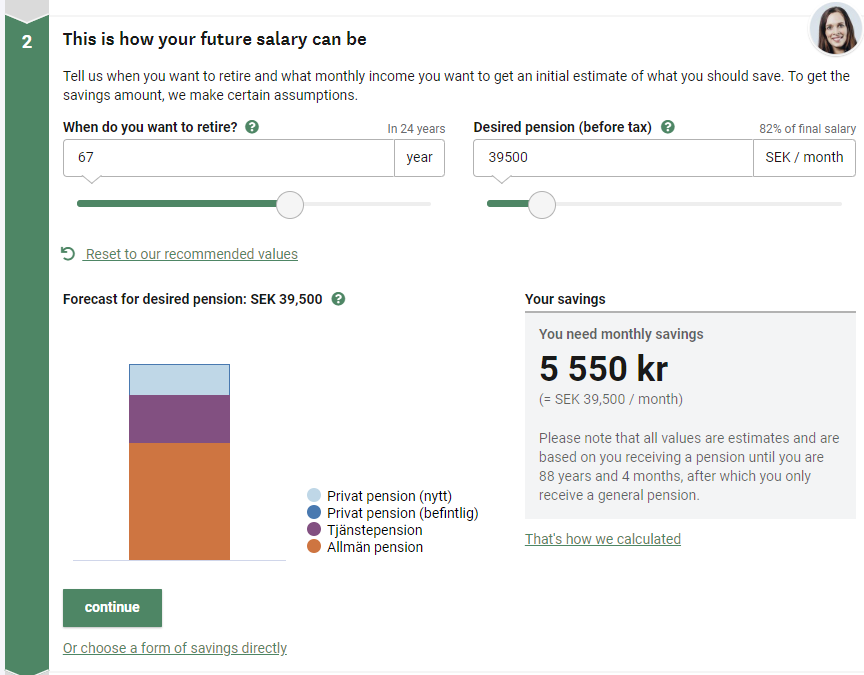

Skandia: Digital Pension Planning Revolution

How Skandia transformed their pension advisory services with KidbrookeONE, launching a sophisticated digital planning solution in just 4 months.

KidbrookeONE Dashboard

Portfolio Value

$124,680

+3.2% ($3,870)

Apple Inc.

AAPL

$187.68

+1.2%

Allocation

Apple Inc.

25.0%

Microsoft

15.0%

Amazon

37.0%

Alphabet

23.0%

Solutions

Tailored solutions for life insurers, pension providers, banks and brokers — built to help business leaders launch faster, empower advisors, and deliver exceptional digital experiences

Customer Onboarding

Capture client goals in minutes with seamless, compliant onboarding

Streamline the first interaction with intuitive, compliant digital onboarding

Capture client goals and data in minutes, creating the foundation for long-term engagement

Self-service Planning

Empower customers to explore financial options at their own pace

Empower customers to explore pensions, savings, and investments at their own pace

Clear, interactive tools build confidence and drive timely action

Customer Portal

Deliver a single, consistent view of customer's financial life

Deliver a single, consistent view of a customer’s financial life

From portfolio updates to personalised insights, your clients stay informed and engaged

AI Agent

Intelligent conversations powered by deterministic financial analytics

Kate bridges natural language with rigorous analytics

Ask in plain language, get structured projections—not generic AI responses

Built for compliance, auditability, and trust

The KidbrookeONE Advantage

How our unified platform solves critical industry challenges

The Problem

Financial institutions struggle with fragmented solutions, complex integrations, and slow time-to-market

The Solution

KidbrookeONE unifies all data and analytics functionality into one seamless platform with a simple, consistent API

The Outcome

Faster launches of new financial products

Consistent experiences across all channels

Reduced technical debt and maintenance costs

Higher customer engagement and satisfaction

KidbrookeONE Platform Architecture

KidbrookeONE

Unified API

Accelerate Innovation

Launch new financial tools in days, not months. KidbrookeONE's ready-to-use APIs eliminate development bottlenecks.

Reduce Complexity

One API for all your financial analytics needs. Simplify your tech stack and focus on creating exceptional user experiences.

Eliminate Risk

Enterprise-grade calculations you can trust. Backed by rigorous financial models and regulatory compliance.

Client Success Stories

See how leading financial institutions are transforming their business with KidbrookeONE

Kidbrooke's platform enables us to describe our funds more clearly to current and potential investors, especially from a sustainability perspective. The implementation was very smooth and fast. We are very satisfied with the collaboration.

Niklas Söderström

CEO, Ruth Asset Management, part of Max Matthiessen, SwedenEnhanced fund transparency

We use Kidbrooke's solution, and we are very pleased with the market-leading functionality … Working with Kidbrooke is and has been a true partnership.

Joakim Pettersson

Digital Strategy and Innovation Lead, Skandia Life, SwedenMarket-leading functionality

We are delighted to partner with Kidbrooke … Kidbrooke provides the cutting-edge technology we need to stand out against the competition and become a true disruptor in our industry, by providing a fully digital insurance experience that is simple and secure.

Mohamed Seghir

CEO, HAYAH Insurance Company, UAEDigital transformation success

Build Anything

Explore the limitless possibilities with KidbrookeONE's flexible modules

Skandia

Digital Pension Planning Revolution

Transformed pension advisory services with a sophisticated digital planning solution, launching in just 4 months with KidbrookeONE's flexible calculation engine.

Key Result

Multi-period goal handling: Supports split retirement incomes and allocates capital across periods automatically

Time to market: 4 months

Ruth Asset Management

Transforming Data Aggregation

Overcame complex merger challenges and automated ESG/market data aggregation, transforming manual processes into efficient API-based workflows while enhancing regulatory compliance.

Key Result

Operational efficiency: Automation allowed Ruth to shift focus to fund management while ensuring consistent, accurate data integration

Time to market: 6 months

HAYAH Insurance

Building a Cutting Edge Digital Life Insurer

Partnered with Kidbrooke to build engaging, self-service investment journeys with KidbrookeONE, driving new goals-based financial planning experiences in the UAE market.

Key Result

Rapid deployment: Three comprehensive digital journeys implemented in less than 3 weeks, significantly improving customer engagement

Time to market: < 3 weeksFrom API-first to Turnkey

Whatever your build strategy, Kidbrooke delivers. Integrate our unified analytics yourself or ask our experts to craft the complete digital experience for you.

Build with Kidbrooke

- Plug-and-play KidbrookeONE API (REST/OpenAPI)

- Sandbox keys in minutes

- Rich developer docs & starter widgets

- Keep full control of UX and roadmap

Built by Kidbrooke

- Dedicated solution squad (UX, quant & cloud)

- White-label screens, localisation & compliance out-of-the-box

- Weeks-not-months to launch (see HAYAH case study)

- Ongoing optimisation & SLA-based support

"Kidbrooke partnered with us to build engaging, self-service investment journeys backed by their simulation engine."

Mohamed Seghir, CEO, HAYAH Insurance

Ready to choose your path? Talk to us

Built for Enterprise Scale

Technical excellence you can trust for mission-critical financial applications

<100ms

Average API response time

99.98%

Uptime SLA guarantee

DORA

Compliant

GDPR

Compliant by design

Ready to transform your financial services?

Schedule a personalized demo to see how KidbrookeONE can accelerate your digital transformation